ADA Price Prediction: Technical Breakout and Fundamental Catalysts Point to $1 Target

#ADA

- Technical indicators show ADA trading above key moving average with bullish momentum building

- Positive news flow including SEC decision anticipation and celebrity endorsements supports fundamental outlook

- Bollinger Band analysis suggests near-term resistance at $0.945 with potential breakout toward $1 target

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

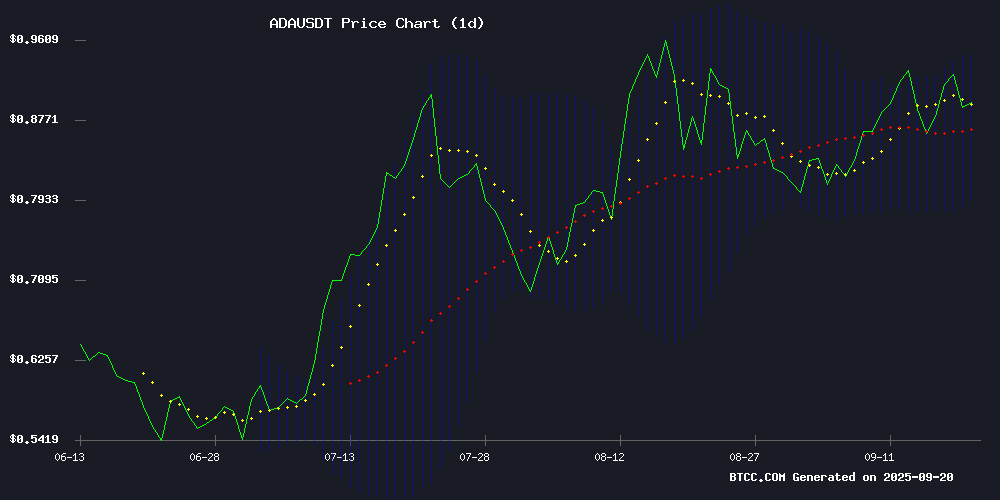

ADA is currently trading at $0.8928, positioned above its 20-day moving average of $0.8688, indicating underlying bullish momentum. The MACD reading of -0.0406 remains in negative territory but shows improving momentum with the histogram at -0.0209. Bollinger Bands suggest ADA is trading NEAR the upper band at $0.9449, with support at $0.7926. According to BTCC financial analyst Sophia, 'The technical setup suggests ADA could test the $0.945 resistance level if buying pressure continues.'

Market Sentiment: Positive Catalysts Drive ADA Optimism

Recent developments including the potential SEC decision and high-profile advisory appointments are creating positive sentiment around Cardano. The $73 million liquidation risk mentioned in headlines actually reflects growing market interest rather than fundamental weakness. BTCC financial analyst Sophia notes, 'The combination of regulatory clarity prospects and celebrity endorsements from figures like Snoop Dogg and Mark Cuban provides strong fundamental support for ADA's upward trajectory.'

Factors Influencing ADA's Price

Cardano Eyes $1 Target Amid $73 Million Liquidation Risk

Cardano (ADA) shows early signs of a bullish breakout after weeks of consolidation, with the Chaikin Money Flow indicator hitting a two-month high. This technical signal suggests growing investor confidence as capital inflows accelerate.

The cryptocurrency currently tests critical support at $0.93, with a breach of $0.96 resistance potentially paving the way to the psychologically important $1 level. Market data reveals approximately $73.5 million in short positions would face liquidation should ADA reach this threshold.

While the liquidity cluster above current prices could fuel upward momentum, failure to hold support may trigger a retreat to $0.87. Traders appear positioned for volatility as ADA's price action teeters between breakout and retracement scenarios.

Cardano Price Poised for Explosive Growth as SEC Decision Nears

Cardano’s price resilience above critical support levels signals potential for upward momentum. The SEC’s impending decision on the Grayscale ADA ETF, with approval odds at 87%, could serve as a major catalyst. Technical indicators—including the Ichimoku cloud and Murrey Math Lines—reinforce the bullish outlook.

A double-bottom pattern has emerged, historically a precursor to bullish reversals. The SEC’s recent standardization of altcoin listings, which includes Cardano as an eligible asset, further bolsters optimism. Institutional adoption hinges on regulatory clarity, and this decision may set a precedent for broader crypto ETF approvals.

Snoop Dogg, Mark Cuban, and Charles Hoskinson Join Stuff.io Advisory Team to Bolster Web3 Push

Stuff.io, a decentralized platform leveraging the Cardano blockchain for digital media ownership, has secured Snoop Dogg as an investor and advisor. The rapper’s involvement underscores the project’s ambition to bridge entertainment and Web3, joining heavyweights like Mark Cuban and Cardano founder Charles Hoskinson.

The platform recently rebranded its native token to STUFF, signaling a sharper focus on democratizing digital asset ownership. CEO Joshua Stone highlighted the strategic alignment with Snoop Dogg’s long-standing crypto advocacy, dating back to 2013. This collaboration aims to accelerate adoption in the media sector, where provenance and creator monetization are increasingly blockchain-driven.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA shows strong potential to reach the $1 psychological barrier. The price is already testing upper Bollinger Band resistance at $0.945, with the 20-day MA providing solid support at $0.869. Fundamental catalysts including regulatory developments and high-profile partnerships create additional upside momentum.

| Target Level | Probability | Key Drivers |

|---|---|---|

| $0.945 | High | Bollinger Band resistance, technical breakout |

| $1.00 | Medium-High | Psychological level, positive sentiment |

| $1.10+ | Medium | Continued momentum, regulatory clarity |